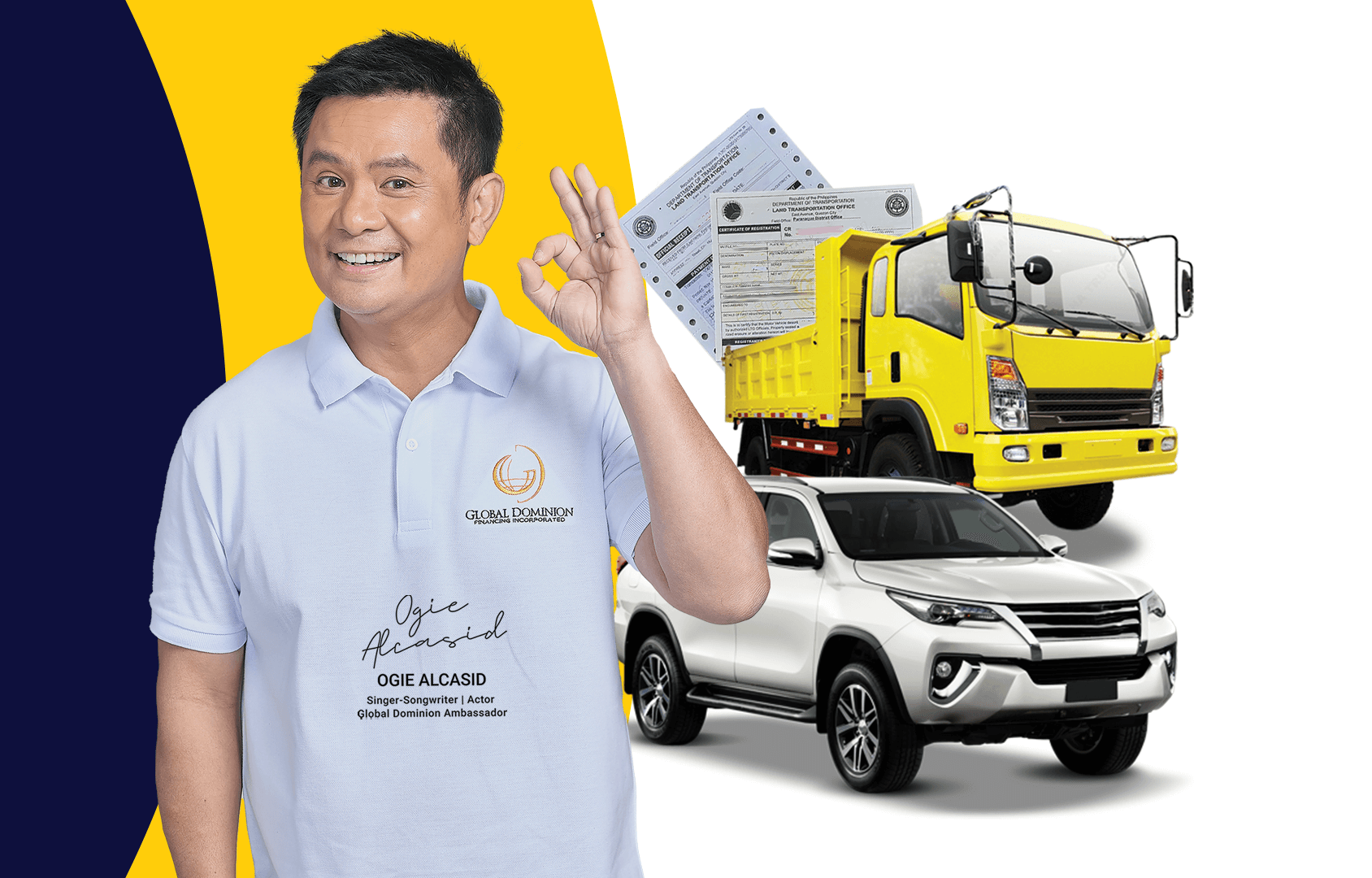

ORCR Sangla Loan: Turn Your Car Documents into Instant Funds

When urgent financial needs arise, many ORCR sangla loan look for fast and reliable ways to secure cash. One option that has gained popularity in the Philippines is the ORCR Sangla Loan. This type of loan allows car owners to use their Official Receipt (OR) and Certificate of Registration (CR) as collateral to access immediate funds—without the need to pawn the actual car.

What is an ORCR Sangla Loan?

An ORCR Sangla Loan is a financing solution offered by lending institutions where you pledge your car’s registration documents (OR and CR) instead of handing over the vehicle itself. This setup provides borrowers with much-needed liquidity while still allowing them to use their car daily.

Unlike traditional loans that require strict credit checks and lengthy processes, ORCR Sangla Loans are designed to be quick, convenient, and accessible for car owners who need emergency cash.

Key Benefits of an ORCR Sangla Loan

-

Instant Funds

Approval and release of funds are typically faster compared to personal loans. Many lenders offer same-day processing once requirements are submitted. -

Keep Using Your Car

Unlike a car pawn where the vehicle is surrendered, an ORCR Sangla Loan lets you keep driving your car as usual. -

Flexible Loan Amounts

The loan value usually depends on your car’s model, year, and market value. The newer and more valuable your vehicle, the higher the loan you can get. -

Convenient Repayment Terms

Borrowers can choose repayment plans that fit their financial capacity, often ranging from a few months to over a year. -

No Need for High Credit Score

Approval is generally based on your car’s value and condition, not your credit history. This makes it accessible for those with limited credit records.

Basic Requirements

To apply for an ORCR Sangla Loan, most lenders will ask for:

-

Original and photocopies of OR/CR (vehicle registration documents)

-

Valid government-issued IDs

-

Proof of income or source of funds

-

Latest car pictures and inspection report

Some lenders may also require comprehensive insurance and the submission of post-dated checks for repayment.

Why Choose an ORCR Sangla Loan?

This type of loan is ideal for individuals who:

-

Need quick access to cash without the hassle of traditional bank loans.

-

Want to keep using their car while borrowing money.

-

Have difficulty applying for unsecured loans due to credit history issues.

Final Thoughts

An ORCR Sangla Loan is a practical solution for car owners facing urgent financial needs. By using your vehicle’s documents as collateral, you can access instant funds while still enjoying the convenience of your car.

However, like any loan, it’s important to choose a trusted lender and carefully review the terms to avoid hidden charges or unfavorable conditions. Used responsibly, an ORCR Sangla Loan can be a lifeline that helps you bridge financial gaps with ease.